Non-fungible tokens, or NFTs, are often thought to be hard to price because some places value on them depending on the art aesthetics, which shouldn’t really be the value determiner. It’s a big misconception some NFT investors do.

Truthfully, NFTs are easier to price compared to the traditional physical work of art. Non-fungible token pricing should be based on the elements.

The rarer the NFT elements are, the more they are desired. Hence, the higher their price should be.

Although that is the case, ranking the rarity of every single NFT is quite tricky, especially if the project’s elements continue increasing. This makes it hard for people to tell which NFT is really rare.

The rarity of the NFTs is typically undisclosed to the main website of the project. No worries though, there are particular methods you can do in order to see which NFT is truly rare and which is not.

NFTs and their Floor Price

Not all NFTs are created equally.

For instance, there is the Pudgy Penguins NFT project. Its floor price is 2.8 ETH. This means that the 2.8 ETH price is the price for penguins that are not considered rare.

So, if you own rare Pudgy Penguins, you can sell them at a price higher than the floor price.

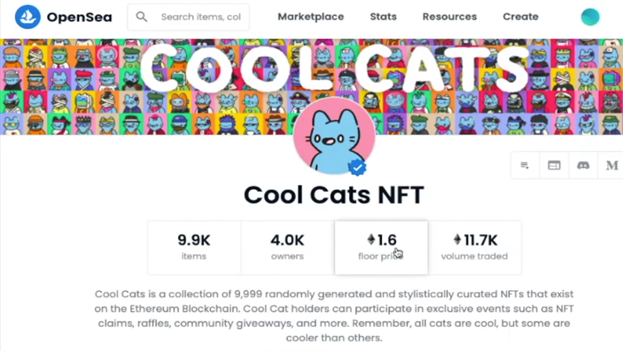

There is also Cool Cats NFT. The floor price for this project is 1.6 ETH for the least rare NFT, which is equivalent to $4,871.66 at the time of writing.

If a Cool Cat NFT you own is one of the rarest, you could sell it for more than $5,000 or even tens of thousands of dollars.

The floor price can be considered as the suggested retail price (SRP) of average NFTs. Rare NFTs are sold higher than the SRP.

To determine which NFTs you can sell way beyond the floor price, assessing the NFT is necessary. Refrain from selling them without going through a rarity check.

You can use certain tools to rank these NFTs, which could be a great help in your NFT journey.

Rarity.tool

Let’s say you bought or minted an NFT project asset which has 8,000 in the individual asset. Out of these 8,000 individual assets, how do you know how rare is yours compared to others?

You can do it manually, but it would take so much of your time.

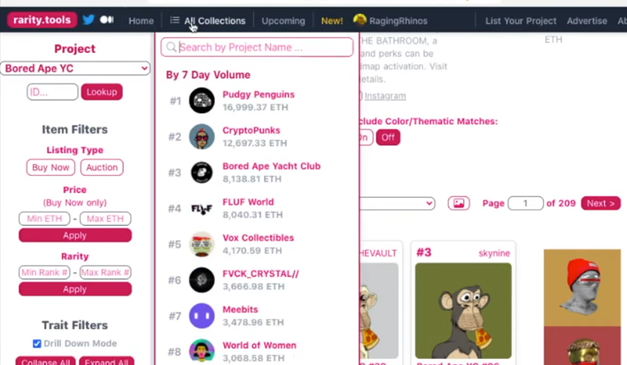

Rarity.tools is a famous NFT ranking tool among non-fungible token enthusiasts. This tool enables its users to store, retrieve information, and rank depending on the rarity of an NFT. Users are also given the perks to look into upcoming drops.

This free online tool is critical to avoid overpaying on less rare assets, finding rare assets with a reasonable price, and adequately putting a price on an NFT item.

Instead of merely playing a guessing game, start leveraging rarity.tools to rapidly find out how rare your asset is and where it ranks within the entire project.

With just a few clicks, the platform will serve the information you want to get about the NFT.

To check the rarity in this platform, you first need to pick an NFT collection. You could use the name or the number of the project to search. Once you do, the tools of the site will score the NFT(s) by adding up all the features of the NFT it has.

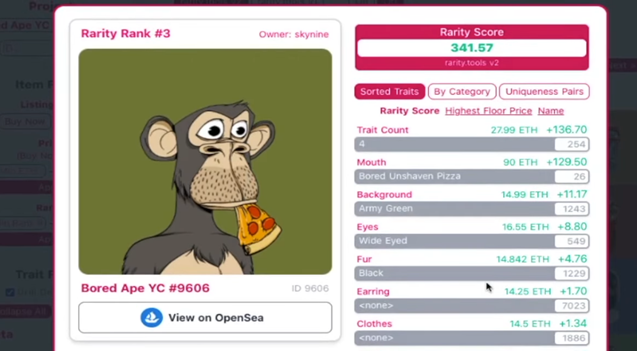

Users will be presented with the NFT’s features, number, floor price, and overall rarity score.

For instance, you want to look at the rarity of Bored Ape Yacht NFT. Click All Collections, and search for the name of that project. After that, you will see different NFTs of the project, and in order to see which is the rarest among, sort it by Rarity.

The floor price for this NFT project is 14.25 ETH, and if you own the Top #1 Bored Ape, the rarest, you shouldn’t sell it just within this floor price.

If you own a Bored Ape with the rank of 9,431/10,000, it might not bring you in that much money.

If you tried looking for an NFT project but can’t find it on the platform, maybe you typed the wrong spelling, or the project hasn’t been listed yet.

How Rarity.tools Rank an NFT

Instead of looking for an extremely rare singular trait, Rarity scores an NFT based on the sum of its holistic trait value. Hence, even if an NFT possesses the rarest 1% singular trait, it wouldn’t pull them up immediately to the top 1% of assets in the entire project.

Rarity.tools examine the whole picture and not just a part of it.

However, it is worth noting that while Rarity.tools rank an NFT according to the scoring model they believe in; the “market” is still the best determiner of the value of NFTs. This is why there are projects where one extremely rare trait surpasses others when it comes to desirability, pushing its value up.

We all grow up knowing that “rare” things are precious, and this is why people are always itching to get limited edition pieces of their interest. Once the maximum number of these limited edition pieces are sold, they will never be produced again. And this is also where the beauty of rare NFTs lies.

Because it will never be produced again in the market, those who bought it early can resell it at a much higher price.

In fact, the currently most expensive NFT sold in history amounts to a record-breaking amount of $69,000,000, which is the third most expensive price paid for this area of work. With inflation kicking in, its price could go way higher than this in the coming years and decades.

The future value of an NFT will significantly depend on the valuation shifts and future cash flow. The valuation is powered by speculation and can sometimes fuel the appreciation of prices.

Most of the time, valuation is driven by the shortage of supply and market speculation. There’s StockX as an example. By encouraging people to theorize on sneaker prices, it has built up a rare sneaker market. Because of this, this sneaker marketplace has pulled off around $1 billion valuations.

NFTs are still new to the market and still need some time to be accepted by the masses. However, from the movement we see right now, it’s most likely to bring a huge change in the future time.

If you hold an extremely rare NFT right now, and no one is willing to buy for a price that you think is reasonable, keeping it for more months or years would be better than selling it at a low price.

And as a closing reminder, again, never sell your NFT without checking its rarity, or you might regret it in the future.