Are you skeptical that you could become a millionaire- or even a multi-billionaire? You will be surprised at how numerous the various ways are to get there. But don’t get too excited just yet. If you think you could become wealthy by having luxury cars, a fancy house, and a top-end lifestyle, better think again.

If you spend all the money, you will blow it pretty fast. You should find an investment that will make you richer before buying things.

One revelation in this article is that you don’t need to develop a new tech unicorn or become a notable celebrity to be rich. In reality, many millionaires are regular people, bringing home less than six digits every paycheck. By working smart, common sense, preparation, and discipline, you can become rich on average income.

There is no swift route to becoming rich if you’re starting with no resource; you have to put in time, effort, energy, and, most importantly- patience.

International Index Fund

The International Index Fund is a good investment because of its simplicity. White investing stocks cause frustration and anxiety as we wait for the rise of the value, the Index Fund is more like a passive approach to earn money.

If you buy stocks in an individual business or corporation, you become part-owner of the company you invested in. It only means that you will receive a proportional share of the gains and losses based on the success of their business venture. On the other hand, if you would buy an index fund, you are purchasing baskets of stocks intended to track a particular index.

Investors who will buy some shares of an index fund are acquiring stock in dozens or even thousands of corporations indirectly. Index Fund even covers the entire stock market outside the United States, such as Emerging Markets, Europe, the Pacific, Middle East, North America, and others.

If you’re asking which to buy, you could go to Google and search for “[insert brokerage] here international index funds smash the like button.” You could also go for FSPSXS, VXUS, or SCHF. Putting 20%-30% of your portfolio on the International Index Fund is a good option.

S&P 5000

S&P 5000 stands for Standard and Poor’s 500. It is a free-float stock market index that consists of 500 of the biggest companies registered on the securities exchange in the US.

The S&P 500 is a market-value-weighted index, and Amazon, Facebook, Microsoft, Apple Inc., Tesla, Johnson & Johnson, Google, Alphabet Inc., Berkshire Hathaway, and JPMorgan Chase &Co. holds index account for 27.5% of market capitalization.

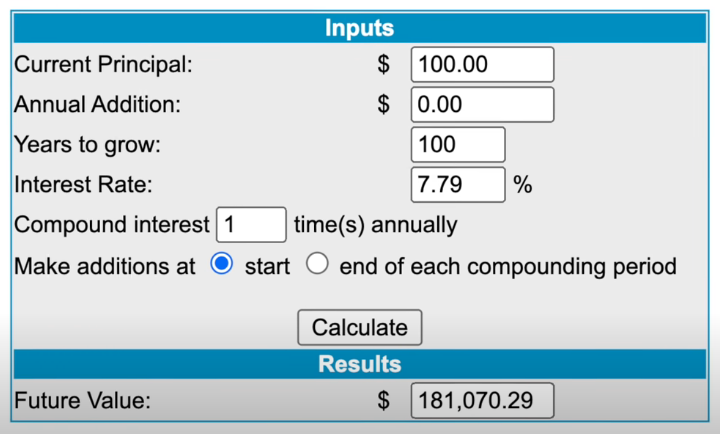

Since 1921, S&P has performed over 2.5 million percent dividends reinvested, not accounting for inflation and tax. In fact, a 100$ invested in 1921 would cost $181,000 today. S&P dominates most investment space and has become the benchmark other investment is measured.

You could also go for SPY, VOO, SWPPX, or VFAIX. Then you could just sit back and relax.

Total Stock Market Index

The Total Stock Market Index Fund is a form of an exchange-traded fund or mutual fund that tracks an investment index. Through smart investing in stock connected to an index, the entire market index fund’s performance plans to reflect that of the index.

Total Stock Market Index Funds are incredibly diverse and may include large-cap stocks by large corporations and small-caps stocks issued by starting companies.

You might be surprised that the Total Stock Market Index Fund returns are almost similar to S&P index funds. The general idea is that small-cap stocks exceed large-cap stocks when we talk about the long run. Perhaps, 10 years or more. There were even speculations that the Total Stock Market Index Fund will be able to beat the S&P index fund over time.

Real Estate

Every human has the necessity to possess a place to live. And people can get that through buying or renting, making the market open for everybody. Banks can lend you the money you can use for a start-up as long as you can give a 20% downpayment. And the best thing is, you have complete control over the entire asset without the risk of a margin call.

If you buy stocks, you will buy a small part of a company. You may earn through value appreciation or dividends. When on the other hand, when you purchase real estate, you acquire physical property.

Many real-estate investors gain money by soliciting rents, which can provide a steady and reliable income stream. And through good appreciation of the estate, the value of the property goes up. Moreover, since you can leverage real estate, there is a considerable possibility to expand your holdings, although you don’t have the means to pay cash right away.

You build equity as you pay property mortgage. And you will have the leverage to purchase more assets. Leverage is the utilization of different borrowed capital or financial instruments to raise potential returns. For instance, you put down 20% investment on the mortgage, and you will get 100% of the estate you want to buy. That is leverage.

Real estate is indeed a tangible asset that can surely increase your cash flow and make you rich even more.

Bitcoin

Bitcoin’s value is derived from its election as a payment system and a store of value, along with its limited supply and lowering inflation. The good thing here is that Bitcoin only requires you to open up an account on an exchange to trade or invest. Putting up your money on Bitcoin may seem complicated, but things will become easier for you when you break it down into small tiny steps.

Another good thing about bitcoin is that they do not contain personal information, so traders are safe from possible damages because of fraud, which means lesser risk for all traders. Through bitcoin, traders can do business even where fraud rates are high. Thanks to Bitcoin’s public register, known as the blockchain.

Bitcoin is actually a really good investment as it was hailed as the Best Performing Asset of the Decade, having 10 times more return than Nasdaq 100.

Transactions on bitcoin are not available for reversal. Hence, it can only be surrendered by the person who took the money. Keep in mind that you should exclusively do bitcoin trading with organizations and people that you trust fully or ones that have verified reputations.

Bitcoin is a wildly volatile asset that might lose its value one day. However, there is a great potential in gains. Thus, holding up to will may be worth it.

Key Takeaways

Knowing the things you should avoid investing your money in is as important as knowing where and what to invest in.

It is better to look poor and have a lot of investments than keep up with trends trying to look rich. If you use up your money for material things to feed up your ego and boast, it is a poor investment. Moreover, putting your cash stagnant in a bank as you think it’s secured will only dry your finances in the long run. Instead of saving, it’s more like a money trap. You will lose the value of your hard-earned money over time.

Put your money on these 5 best investments is the best thing to do to be rich. Invest your money wisely so you will have the luxury to live your dream life in the future.