Gone are the days that we stand in awe of science fiction movies for catching a glimpse of the digital world, today, more than just feeding the eye, metaverse can probably be a pathway to success in the future that will not let our stomachs growl in hunger.

The claimed next generation of the internet, Metaverse, has been in a global public discourse after Facebook rebranded itself to Meta and Microsoft expressed its plans to introduce over 250 million users to the ‘digital world.’

Traditionally, index funds have always been a popular investment option for people looking for a broad and safe sector or asset class, and it got adopted in emerging cyberland. You can lean into the metaverse for profits even if you don’t own a multi-billion business like the two previously mentioned. Metaverse index fund investment opportunities are open for both cryptocurrency and stock ventures.

Bloomberg reports that the market opportunity for the metaverse is expected to sweep about $800 billion by 2024. “Omniverse or the metaverse is going to be a new economy this is larger than our current economy,” NVIDIA CEO Jensen Huang stated.

The metaverse economy is thriving and as a savvy investor, you need to put your efforts into smelling out good metaverse index funds that may be the receptacle of your dreams.

Here are the top three metaverse index funds that will let you invest in the internet’s future:

Metaverse Index Fund (MVI)

Let’s begin our journey with a cryptocurrency index fund— Metaverse Index (MVI).

MVI was introduced by Index Coop, with a proposal stating that metaverse index is “designed to capture the potential upside of the new but growing group of projects on Ethereum that relates to the virtual ownership through NFTs, virtual reality, entertainment, and online gaming.”

Although it is composed of the cosmic names in the metaverse space, MVI is still in its infancy, having a diminutive market cap of around thirty-four million dollars.

Since the cryptocurrency market is highly volatile, prices fluctuate every day, so metaverse investments might be too risky to venture individually. Metaverse index is created to solve this problem.

Currently, the biggest names in the metaverse space are included in this index, namely Illuvium, Axie Infinity, SAND, Decentraland, Enjin Coin, etc. If one of these coins decline, the other will serve as a cushion for an investor not to lose their money entirely.

Basically, if one coin within the index is down, the other fund that goes up will make up for it.

Metaverse Index has certain criteria for inclusion in its index. This includes:

- The protocol must have a complete independent audit.

- The protocol and associated token must have no less than three months of history.

- The market cap tally must be over $30 million.

- The token must be on the Ethereum network.

- The protocol should be among the Coingecko categories such as Music, Entertainment, Augmented Reality, Virtual Reality, and Non-Fungible Tokens (NFTs).

To maintain this index, two phases are executed every month: the determination phase and the rebalancing phase.

This index fund is suitable for investors who want a lower risk. There’s a downside to this though. Because it is on the Ethereum blockchain, this fund is getting traded on decentralized exchanges, which demands high gas fees.

Dollar-cost averaging won’t work in this investment since the gas fees can cost about $50-$200 per buy, which is not really feasible. This investment will make more sense for people who are planning to make big, infrequent buys.

You can buy Metaverse Index (MVI) in Token Sets, an asset management tool that offers a variety of index funds. Other indexes available in their platform includes Data Economy Fund, DeFi Pulse Index, and Bankless BED Index.

The Ball Metaverse Index

The Ball Metaverse Index is a trailblazer in performance tracking of the metaverse. It is made up of a definitive listing and ranking of companies that are building the “new” internet through a proprietary methodology. This index fund has a relatively low expense ratio of 0.75%.

Metaverse companies that are developing infrastructures that are significant to the metaverse such as Nvidia and Cloudflare are the target of this index fund. As well as companies pioneering in content, social, and commerce for the metaverse, and gaming engines that are responsible for the creation of virtual worlds like Roblox and Unity.

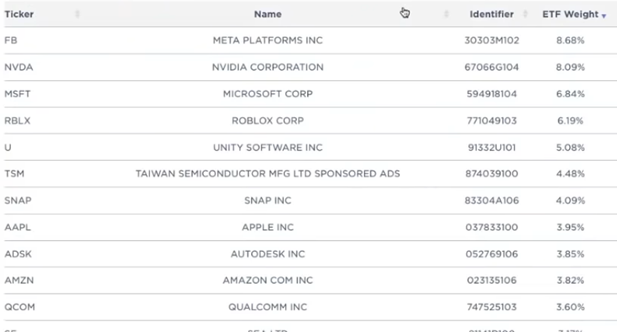

Ball Metaverse Index portfolio is made up of notable multinational companies like Meta Platforms Inc., Microsoft Corporation, Nvidia Corporation, Roblox Corporation, Unity Software Inc., Amazon Com Inc., Apple Inc., and Autodesk Inc.

Even putting metaverse aside, the mentioned companies would give you good returns since they are already well-established in their own field.

This index fund is available on trusted exchanges and brokers like Robinhood, SoFi, Ameritrade, InteractiveBrokers, Public.com, E-Trade, Fidelity Investments, and Vanguard.

ProShares

ProShares exists even without the Metaverse, as it is a division of ProFunds Group that is responsible for managing investment funds with combined assets under management of about $58 million.

Compared to other giant asset managers, ProShares is a merely small investment company. Regardless, it offers a unique set of funds that follow various asset classes and indices.

The company takes pride in its numerous exchange-traded fund (ETFs) that are designed to execute a particular speculative investment strategy. Recently, they have filed an application with SEC for a metaverse ETF, which will heed the undertaking of the Solactive Metaverse Theme Index.

ProShare stated, “The index will give the ETF exposure to the U.S. companies listed on New York Stock Exchange (NYSE) or the Nasdaq that meet certain market capitalization and liquidity requirements.”

Pretty similar to Roundhill’s Ball Metaverse Index, ProShare’s metaverse-related index fund will include super companies like Mircosoft, Apple, Intel, Meta, and Nvidia. This index fund that ProShare is low risk.

The potential of this digital space is gigantic. Platforms that have shifted to the metaverse are already seeing good results. Still, the overall market is yet to reach maturity in the next few years. If you are willing to go for a long-term investment, an index fund might be slow, but it will surely give you substantial profits.