Once consigned to the global financial system’s surface borderlines, cryptocurrencies like Bitcoin have entered the world of finance in a disruptive fashion.

Cryptocurrencies may appear to be just new to this generation, but the aim of creating a more accessible and open financial system dates back to the 1980s. Yet, although there had been many attempts to design a system with a lower cost and greater privacy, Bitcoin was the first-ever viable cryptocurrency created last 2009.

Let’s revisit the history of money to understand Bitcoin clearly.

Money represents a specific value.

If we look back at history, value has come in different forms, and people used various things to represent money— perhaps wheat, shells, salt, and gold, which are all used as means of exchange way back.

If you do work for someone, you receive money in return for the value you give. Then you can use that money to acquire something valuable from someone else on the time that is to come.

However, for people to consider something “valuable,” people should come into an agreement that it is really valuable and will stay as it is long enough for them to redeem value in the future.

Hundred years ago, people considered a “thing” to represent money. Then, later on, a shift happened from “something” to “someone.”

As time passed, people found it an inconvenience to walk around carrying heavy gold bars or other things that represent money, which led to paper money.

For instance, you have a gold bar.

The government or a bank would offer to take possession of it and give you a receipt certificate or paper bills, equivalent to the value of gold. Let’s say a gold bar is worth $10,000, and then you will receive $10,000 if you give your gold bar to the bank.

These paper bills brought convenience to many. Just imagine getting your gold bar cut because you want a cup of coffee. Back then, if you’re going to redeem your gold, you just need to give the $10,000 bills back.

A lot of things happened, and the rest is history, but basically, people ended up trading paper bills instead of gold.

People continue to trade bills that are only backed by the government’s promise. So Although there’s no actual commodity supporting paper money, the government gave value to it, the masses believed, and that’s how fiat money came to the surface.

Fiat means “by decree” in Latin, which means dollars, or any currency that has value because the government puts a value on it. It is known as legal tender, a banknote, or a coin that should be accepted as payment.

In a nutshell, the value of money today was given by the central authority, and so the model of value shifted from something (wheat, shells, salt, gold, etc.) to someone (government).

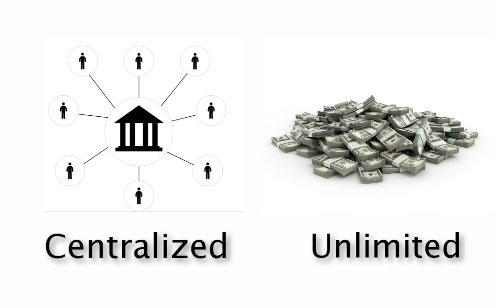

However, these fiat currencies have two primary drawbacks.

First, they are centralized. There is a central authority that issues and controls it. Next, it is not limited in quantity. Meaning, central banks or the government could print as much as they desire, which may cause inflation in the money supply in the market.

Once the market is flooded with money, the value of each dollar drops, making money worthless.

Fiat money was already in place, so the transition to digital money was quite simple. At present, people mostly use credit cards, PayPal, wire transfers, and other digital money, making physical money almost negligible. Its value is getting smaller every year that passes.

Just like physical money, digital money is limitless. Come to think of it, if you have a particular file that represents a dollar, what would stop you from doubling it as much as you want and having a million dollars, right? This is known as the “double-spend problem.”

Due to the people or organization having control over the supply, called “central authorities,” problems like mismanagement and corruption are most likely to arise. And so, people devise solutions to remove someone’s power over currencies.

There were many attempts to make alternatives to solve the double-spend problem without the need for central authorities, but none of them were successful. Not until 2009.

An individual calling himself Satoshi Nakamoto published a document in 2008 suggesting a way to create a system for a decentralized currency called Bitcoin. Nakamoto claimed that this system could solve the double-spend problem without having to depend on a central authority.

Since we are shifting to digital, banks technically manage their own ledger of transactions. On the downside, only they (the central authority) have control over it. Banks’ ledgers are not transparent, and you can’t take even a glance into them.

On the other hand, Bitcoin is designed to be a transparent ledger where people can take a sneak peek to see balances and transactions. Despite the transparency, people are still given privacy because the identity of the owner remains confidential.

Bitcoin In a Nutshell

Bitcoin is a pseudo-anonymous system— transparent, trackable, and open yet confidential.

With Bitcoin, there is no central computer that holds the ledger. Every computer that joins in the system keeps a copy of the ledger known as the “blockchain.” The records are called “blocks.” If a block is edited, the entire blockchain is synced instantaneously. So, on chance, a hacker wants to take down or manipulate the ledger, he will be needing to take down thousands of computers constantly updating it.

Blockchain could be the technology that would revolutionize the financial world. Perhaps, it has begun to do so. This technology lays off intermediaries, saves time, reduces costs, and provides even more significant financial privacy for participants.

Through blockchain, transaction complexities are reduced. For instance, you buy stock through blockchain; the transaction will be settled within a few minutes, unlike on banks that could take hours or even days.

Financial experts said that the banking sector alone would save around $12 billion if they switch to the blockchain ledger. Indeed, cryptocurrency technology has the power to seriously change the way people do business and even make global financial negotiations more seamless.

Bitcoins are digital coins. There is no actual tangible Bitcoin, but only rows of balances and transactions. Owning a Bitcoin means having the right to access a certain Bitcoin address in the ledger and remit funds to a different address.

What’s the deal on Bitcoins?

Well, Bitcoin is the first decentralized currency, solving problems with centralized currencies. No government nor bank has control over the circulation of Bitcoins, even Satoshi Nakamoto himself.

With Bitcoin, only you have the power over your funds, and central authorities can confiscate or freeze your holdings. Moreover, Bitcoin is cheaper to utilize compared to traditional money orders and wire transfers.

A digital commerce for 2.5 billion people who don’t have access to the present-day banking system was opened by Bitcoin. These people can be either underbanked or unbanked, but they can begin trading with just a few clicks and snaps on their mobile phone without permission from central authorities because of bitcoin.

Nowadays, numerous merchants accept bitcoin. You can book a hotel or flight with Bitcoin. There are also Bitcoin debit cards that will allow you to pay with your Bitcoin balance.

There is yet so much to know about Bitcoins, and that’s why although there are already many people flocking to earn money from it through buying, or trading, Bitcoin is still on the road to find its way to appeal to the majority of the public.