The billionaire American investor Ray Dalio has highlighted six measures that could assist in identifying an asset price bubble. In his Twitter thread, he points out the amount of leverage in a purchase and the quantity of “new investors” to which experienced investors need to be attentive.

Dalio is the founder of the world’s far-reaching hedge fund— the Bridgewater Associates. He has been investing for over 50 years. For the duration of his career, he has studied the history of Economics extensively in order to comprehensively understand how economic situations tend to take shape in the market.

The S&P 500 has accomplished Nasdaq successive records, disembarking highs of 32.8% and 61.6% despite the pandemic in 2020.

Given the extreme appreciation in prices amidst the pandemic, the respected investor has spoken again about the levels of economic stimulus, warning people about the signs of bubbles on the stock exchanges.

High Prices Relative to Traditional Measures

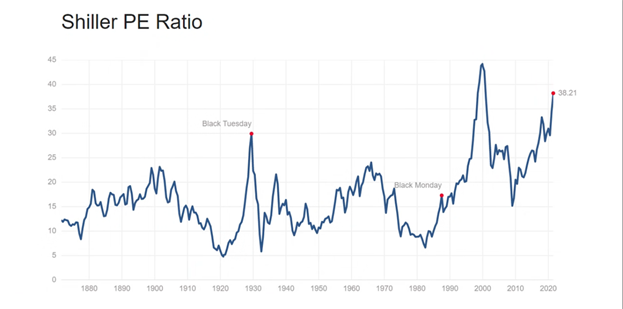

“How high the price is relative to the traditional measures of prices is a consideration. For example, our PE is high or yields low. That kind of thing. That’s a consideration, but it’s not what I mean by a bubble. Let’s say, for example, you can have prices high, which means returns are low. And you can have that go on for a very long time. That doesn’t mean a bubble pops, so I am really looking at whether you get a pop, but still, it’s an ingredient,” Dalio explained.

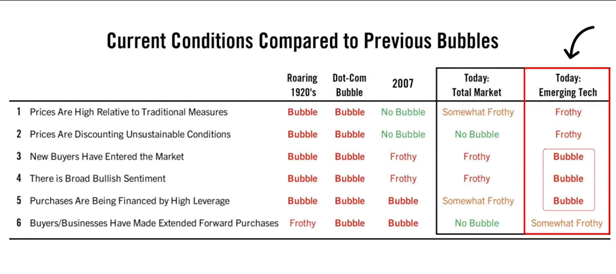

Dalio classified the current market as “somewhat frothy” or not in a full-time bubble.

Today’s Shiller PE ratio for S&P 500 is almost at the highest it has ever gone at— higher than that of 1929 and 2008, yet not as high as the technology bubble. Although it appears that the market is already in the bubble right now, Dalio classified it as somewhat frothy because he has compared the stock valuations to bond valuations.

If you invest in bonds right now, you are agreeing to take up 75 times price to earnings ratio share on this bond, regardless of which market you are looking at. Even if the stocks right now are at 38 times, it should still be better parking for your money compared to bonds.

Prices are Discounting Unsustainable Conditions

Dalio’s second sign of the bubble was made clear, “Unsustainable means by the nature of buying. Whoever is doing the buying, and how of that supply and demand. That means that won’t be sustained, and that produces a correction, and the price is going down.”

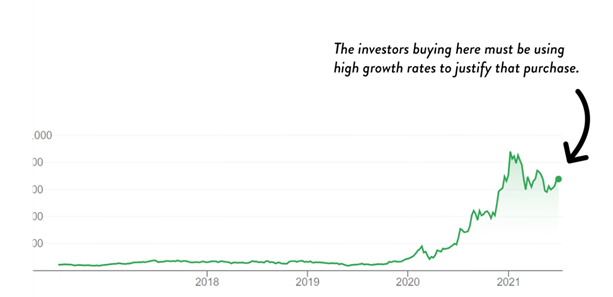

Do you think the prices you see now mirror the growth rate for the future?

A business can reach its full potential by growing the cash flow into the future at a certain growth rate, perhaps around ten years. After that, discount the future cash flow into what their value is today and add the discounted cash flow to the intrinsic value. Basically, this is how most investors value stocks.

The share price is really high these days, and whoever bought at such a high price is expecting enormous growth in price in the future. Our prices today mirror unsustainable growth rates, and investors use that in their valuation models.

Interestingly, Dalio believes that the prices can continue to rise in the future. For Dalio, this sign indicates that stocks of the future emerging technologies would only be “bubbly,” but the market today would still be far from a bubble.

New Buyers in the Market

According to Dalio, the entry of “new” investors could be a sign of a bubble, “One of those measures of speculative elements is new buyers in the market. They are attracted to the market. You know you go to a cocktail party, and people who are never involved in a thing are investing in it, and that could be tech stocks, and it could be real estate or whatever. But they are drawn in, and there’s a day bullish sentiment, so everybody wants not having these things makes you feel dumb.”

There are currently a lot of new market participants, and many of them are hypothetical in their buyers.

For example, Robinhood— a stock trading and investing application— already has 18 million users right now, which is more than double its 7.2 million users in the past year. There’s a lot of people right now who have the money. They go to the platform and want to try out investing. Perhaps you could even hear a physiotherapist talking during their lunch break, wanting to buy Bitcoin.

The flood of new investors could signify a bubble, but the technology stocks are way more alarming.

Broad Bullish Sentiment

This comes from the “feeling out of place” sentiment of most people today because of social media. When you don’t buy something that most people purchase, you feel like you don’t belong.

People always want to get into trends, and so they do, followed by another who wants to “belong,” and then the cycle goes on, and this happens not just in retail. Nowadays, not having a particular asset that everyone else does “makes you feel stupid,” Dalio stated.

The bullish sentiment of this kind points to a bubbly market situation and creates bubbles in the emerging technology stocks.

Leverage Purchases

Dalio explained, “If somebody’s buying apartments that they don’t own because they think that the apartments are going to go up…” A big sign of a bubble is when a lot of people are committing themselves to a lot of debt.

In 2007, people could buy five houses even without income. People are overt extending themselves in debt, which sets up a giant bubble that could burst up quite quickly.

Even a slight plunge in the market could cause people to sell off their assets because they are not able to keep up with the levy of their debts. This could create a downward pressure on whatever market you are looking at, whether it be real estate, stocks, or any market you could think of.

There’s no doubt that purchases that are being financed by leverage could cause a bubble.

Extended Forward Purchases

“Those who use commodities, instead of buying for some purpose, would be accumulating in stock to protect themselves against the rise in prices,” Dalio stated.

Business sales seem to be artificially strong now because buying is extended forward. However, it will look weak in the coming years, and there will be sort of a lull in sales because it was put forward.

This was part of the situation in the years prior to the crisis, but it’s not happening today.

Ray Dalio’s speculation doesn’t suggest that we are currently in a bubble. However, his conclusion shows that three out of his six criteria are “bubbly” on emerging technologies. Perhaps, he suggests that although there is still no sign of great danger in today’s market, investors and buyers should pay attention to the emerging technologies.

These six signs or criteria aren’t really getting applied by Dalio in the entire market, and instead, this framework is used to judge individual businesses.

Nobody can time the market, no matter how hard you research or dig into information. Hence, rather than looking at a framework like this to create a prediction on the market in general, use this instead to study individual companies and stocks that you want to invest in.