Warren Buffett’s ability to tune speculations and outside noise during a market downturn is what brought him to an unrivaled performance in the stock market over the past decades.

Berkshire’s market value has dramatically increased at an annualized rate of 20.9% between 1965 and 2017, doubling the annual growth of the S&P 500 by 9.9% at the same period. Berkshire’s 20.9% market value is equal to 2,404,748% growth, ravaging the 15,508% gain of S&P. This market performance was notably achieved during a market crash.

If there’s anyone who can share a piece of good tips on what to do during a stock market crash, that will be Berkshire Hathaway’s chairman and CEO, Warren Buffett.

Let Buffett’s advice help you navigate the market during uncertain times despite the countless speculations, opinions, and panics.

Have Some Cash Ready

One of Buffett’s principles that protect him from rough times in the market is keeping cash ready on the sideline.

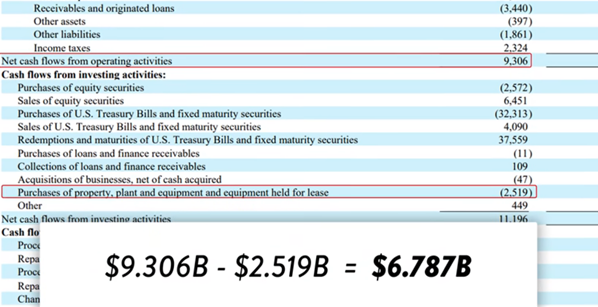

Berkshire Hathaway holds $142 billion in cash or short-term treasuries, which is about five years’ worth of their accumulated cash flow. For the context of how outstanding it is to have such a huge amount in treasuries, you can look at Apple to compare.

Apple —one of the largest companies in the world— only holds about $70 billion in cash and short-term securities. Imagine just enormous Berkshire’s cash holdings are, double of Apple’s cash!

Buffett is holding a huge amount of cash right now, and his portfolio value is about $270 billion. If we calculated Berkshire’s cash and Buffett’s portfolio, we would see that Buffett is currently sitting at 34% cash. Though, there’s still a lot of factors to consider because the cash is actually to safeguard Berkshire’s current business.

The company probably keeps enormous money in the short-term treasuries because of the current state of the economy and stock market.

Warren Buffett stated once that he needs that $142 billion to protect Berkshire’s business to prepare for the worst-case scenario. This could be considered a hint to investors to spare cash, but it could also just be a function of his investment strategy.

The typical Buffet would not really put cash in stagnant, but instead, put it in high-quality businesses. However, because most of the businesses right now are overpriced, Buffett is not buying too much in the market. We know that he’s the type who will never pay too much for a stock. Hence, he’s going to accumulate more cash. Always have cash so you can make bargains immediately if there are any.

Avoid Margin Debt

To protect yourself in a market crash, you should avoid margin debt.

Margin debts come from borrowing money in order to make investments. However, if stocks fall with you having quite a lot of money invested on margin, you might receive a margin call to pay up.

If you don’t have enough money to pay it off, you will be forced to sell your investments, which would make you lose a lot of money. This is why Buffett has always been on the dark side of margin loans.

It would be best to focus on eliminating margin loans, especially when the market is overvalued. Highly valued stocks can be corrected quickly, and if you have a margin debt, this will probably trigger a margin call.

“Four times in 53 years I’ve been in Berkshire, the stock has gone down anywhere from 40% to 60%. Sometimes, very fast. In October 1987, people had a perfectly decent investment. If they borrowed against it, they’d lose it. It is crazy, in my view, to borrow money. You do not know tomorrow morning. You don’t know if the stock exchange will open tomorrow morning. We have closed the stock exchange during World War.

We have closed it for months. We closed it after 9-11 for a few days. It’s insane to put what you have and need into something you don’t really need. You know, borrowing money is a way to get rich a little faster, but there are plenty of good ways to get rich slowly, and you’re getting fun while you’re getting rich as well,” Buffet stated in one of his interviews.

Buffett was absolutely right when he said that margins could increase your returns, yet it comes with great risk.

If your margin loan is invested in stocks that are so overvalued, then the risk will be much higher. Even just a stock price going back to its fair intrinsic value could be the reason for you to sell and take a huge loss.

Get rid of margin debts. Your future self with thanks you once the market plummets anytime soon.

Don’t Speculate

Currently, the market is overvalued, and money is getting thrown at stocks, so it’s pretty hard to get good returns just by investing in solid and high-quality businesses because their price is costly.

Now, because good quality businesses are so high in value, investors tend to put their investments into riskier asset classes and seek high returns elsewhere. This is something that Buffett would have never done.

Most of the time, the riskier the asset, the more it gets crushed in a market crash.

Although all assets will surely get crunched once the market face setbacks— if a company has a consistent growth in cash flow, a great competitive advantage, and a good manager over the past decades— investors should put their faith in that company instead of putting it in a nonproductive asset.

“When you buy a farm, you look at the crop every year and what prices are, and you decide whether it was a satisfactory investment. I mean, you look to the asset itself and what it produces for you.

Once we buy a business, we look at what the business earns and decide what we feel about it in terms of what we paid. But we are buying something that at the end of the period, we not only have what we bought in the first place, but we have something that the asset produces. And when you buy non-productive assets, all you’re counting is that whether the next person is going to pay you more, but the asset itself is creating nothing.” This is Warren Buffett discussing why he never put his money in a speculative class investment.

During a market crunch, a non-productive asset just adds uncertainty, and so they get crunched much harder. Don’t let emotions and speculations rule your decision.

Hold High-Quality Businesses

This principle is perhaps the result of not speculating the market too much to chase returns. Holding businesses with good performance over decades is the best way to be prepared in a market crash.

Ensure that even if your portfolio falls down to 30%, the businesses that are in your portfolio are solid businesses. There are three main factors to look at in a business— the competitive advantage, the management team, and the simplicity of the business.

Holding only high-quality businesses is the best way to outsmart market crashes because businesses that are managed greatly and have solid cash flows are unlikely to get bankrupt.

There’s far-fetched that your investments will fall to zero. Moreover, even if your portfolio sinks, you don’t need to panic because you know they are a great business, so you could just hold onto them.