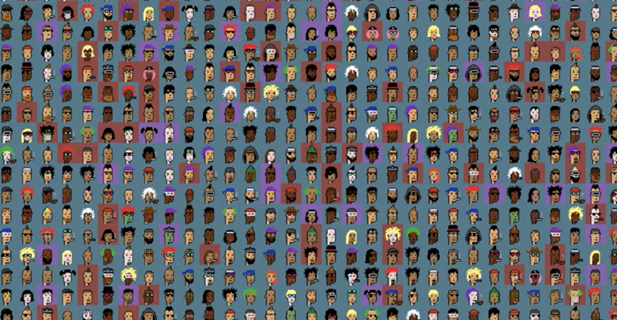

The cryptocurrency market is always on the move. Various kinds of assets are emerging one by one, from stablecoins to altcoins and other token projects. In recent years, a new type of crypto disrupted the market, starting a revolution of non-fungible tokens, or what is known as NFTs.

NFTs rapidly triggered the spring up of its varieties, having fast-rising valuations.

If you plan to buy NFTs as an investment, choosing which one to mint is already hard enough, but deciding to sell it or hold it for a little longer is quite more challenging. It will be a dilemma if you will choose randomly and decide on a whim. You have to evaluate the NFT’s demand.

Market research should never be neglected. From getting to know your NFT to your target audience, market research for NFT demand helps build a competitive edge.

While comprehensively understanding the ins and outs of the entire NFT space is confusing because it’s still in its early days, evaluating NFT demand is not rocket science. In fact, there are two simple ways on how you can do it.

Evaluate the Wallet Decentralization Ownership (Community)

Let’s say there are 10,000 NFTs. A 1:1 ratio of an individual and NFT would be ideal. The community would come so strong if this is the case. However, this is hardly attainable when it comes to cryptocurrency assets. And so, just the number of wallet owners within the community are used to evaluate the demand.

The number of owners and wallets will determine the value of the community— the more owners, the better the community. If there’s 10,000 and the ratio is 5:10,000— there’s really no strong community built.

Bored Ape Yacht NFTs have set a golden standard in the NFT space. There have 10,000 items in their collection, and they have 5,200 owners. Their community is coming strong and solid.

In evaluating the demand in the NFT space, you should look for something which has a ratio of 4:1, four NFTs collectibles in one wallet, four or below. In the Bored Ape Yacht case, the general wallet and NFT ownership ratio are 2:1.

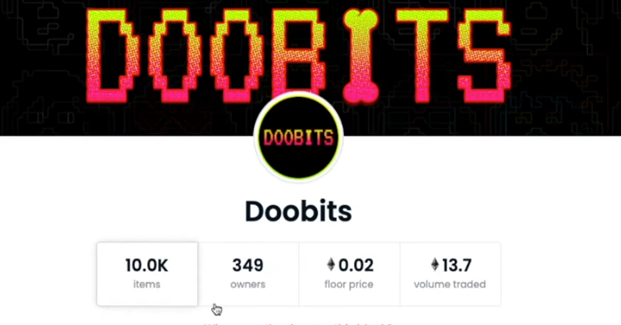

Now, there’s this NFT called Doobits, having 10,000 items just like Bored Ape Yacht. However, the number of wallet owners is just 349. If we calculated it, the average would be 28 items for every collector. The community here is not coming strong.

Evaluating the number of items is also necessary. If an NFT project is only hundreds of items in its collection, it may be better not to buy one of them. If you already own one, sell it at a reasonable price.

Growing the community will be hard if a project only has few listed items because there’s less demand. And if the community doesn’t grow, you know what comes next.

An NFT project should have enough items to create a community. At the same time, enough to build a community. However, if there’s a good potential in the NFT, you might want to do further research to evaluate its possible demand in the future based on the demand you see right now.

Community is critical in evaluating the demand of an NFT.

Although it’s ideal to have every item have one owner because it’s still far from reality to be achieved right now, having an average of four or fewer NFTs per owner already signifies a good community and high demand.

Evaluate Recent Volume Trends

Most often than not, projects that have been around for a long time usually have a higher value than those just recently released. In evaluating the recent volume trends, examining the early stages of an NFT project demand is essential.

One example of a project with high demand and volume is CryptoFunks. This demand pushed its price to $149,701.87 or 48.48 ETH for the lower-priced CryptoFunks.

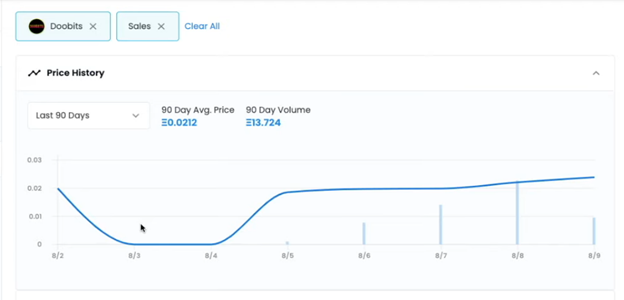

After the first stage of evaluation of wallet decentralization, the next thing you need to do is to look at the value of the project, not against its competitors, but against itself.

Looking at the traded volume of Doobits, there’s nothing much happening in their items, no increase nor decrease in the traded volume. The lines were flat over the last week.

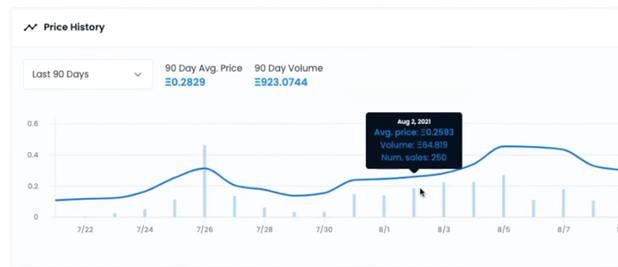

Now, in this chart, we can see that this cryptocurrency, The Doge Pound, has been in an uptrend in the previous weeks, then in the recent weeks, there has been a pullback.

If the trading volume of the NFT is doing good, in an upward trend, then there’s a good demand. If it’s stagnant and remains in a flatline, then not many people are riding on it.

What Drives an NFT Demand?

Determining the demand for NFTs is quite easy with OpenSea. You just have to evaluate the two important things listed above. But what drives these demands? Why do people go for some but avoid others?

Here’s a brief simplification of what drives NFT demands.

Tangibility

There are NFTs that are tied up to real objects, giving them value backed by immutable ownership. Just to be clear, having solidified ownership rights will not make an NFT in high demand. Instead, the underlying value like scarcity, practicality, and of course, the personal satisfaction it brings to users.

Let’s say when you buy NFT #1, you will get a bottle cap; if you buy NFT #2, you will get a ticket to an exclusive event where you can meet famous celebrities.

On a personal level, NFT #2 will bring more satisfaction than a piece of a bottle cap. Hence, there will be a higher demand for it, compared to the other one.

While demand brought by tangible value like tickets is short-lived, NFTs paired up with a real limited-edition pair like sneakers can bring much value in the future, increasing its demand.

Utility

An NFT’s utility emerges from a real application. It could either be for the digital or physical world.

For instance, NFTs can be deemed valuable if people can use them in games, whether as a character, virtual land, or spell. These given characteristics give NFTs value, and the value appreciates depending on the popularity of the project. This could drive demand in the market.

Early this year, the sales volume in the entire NFT market had skyrocketed, breaking the highest record in June. The industry’s demand is induced by the NFT’s personal and intrinsic value. The endless possibilities that lie within an NFT are one of the drivers of its demand.

The cornerstone for the NFT craze is its uniqueness. Whatever you feel about them, they are getting adopted in various industries, and the demand is getting higher and higher in general.

NFTs are truly having a moment, and they are going strong. In fact, the market is receiving new visitors every day, which may push the demand higher. Thus, you should evaluate the demand of your NFT to know how much you are going to sell them for or how much you should pay for them.

Value can be visible in the adaptation and acceptance of the NFT in the market, which people could easily evaluate through the size of its community and volume trend using the platform OpenSea.

While some say that the demand for NFTs is not permanent and was just brought by the hype, some are saying that they are to stay.